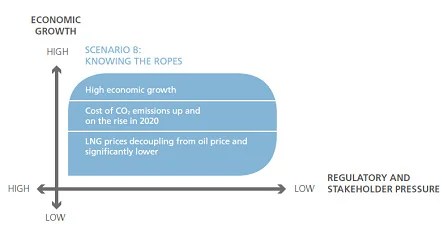

“Knowing the ropes”

International report revealed that with growth rates of 4percent in the Western world and 8percent in China and India, the world economy is strong. The exploration for and production of natural resources is increasing due to strong economic growth. This has a substantial effect on seaborne trade, especially the bulk and container markets. Trade growth doubles compared to world growth. In this scenario, Inter-Asia trade is expected to triple by 2020 compared to the 2012 level. This has a strong impact on the midsize container segment, bulk segment and associated port facilities.

Overall, the experts also estimated that the size (dwt) of the 2020 world fleet to increase by 50-60percent compared to the 2012 level. The prices of HFO and MGO follow the oil price and remain at a high and increasing level by 2020 and beyond. MGO is 150percent more expensive than HFO, while the price of LNG is decoupled from the oil price due to rising production and gas price developments in general. LNG is an attractive ship fuel from a price viewpoint with the LNG price per tone at 30percent of the HFO price. LNG bunkering networks (terminal and barges) are being developed across main bunker locations and in locations with strong trade growth. Innovation and technology developments relating to LNG as a fuel are strong. They have a legally binding agreement on global cuts in CO2 emissions that includes all countries, including the US and China. The EEDI scheme has been further developed beyond its 2013 introduction and is mandatory for existing ships. The Experts also expected to observe a forced phase-out of energy-inefficient ships, similar to what experts saw for single hull crude oil tankers. There are major commercial implications for shipping companies and yards and these are strong drivers for innovation and technology development in the shipping industry.

[ads1]

In 2020, ECAs cover all coastal areas worldwide. There are no ‘sanctuaries’ to be found for ships emitting SOx, NOx and PM. The transition to low sulphur fuels, in particular LNG, is shipping’s strongest trend. The BWMC has been ratified to a level covering 80percent of merchant shipping, and is a strong driver for technology uptake in this area. There has also been some success in implementing MBMs, and the global cost of CO2 emissions is effectively in the range of $50 to $100/tonne.

In a world where there is high regulatory and stakeholder pressure combined with strong growth in seaborne trade, shipping thrives through a high degree of innovation and technology development. They see an increased focus on environmental performance by charterers, forcing ship owners to implement environmentally friendly technology. R&D funding is tripled compared to 2012 levels. Retrofitting in order to meet regulations and support environmentally friendly shipping is a booming industry. Investment in technology and innovation in this area is, for commercial reasons alone, seen as a way of gaining a competitive advantage. Integrating sustainability and environmental issues into company strategy is seen as a differentiator; opposing initiatives have a huge downside and include the risk of tarnished reputation.