[box type=”info” align=”” class=”” width=””]Saemoon Yoon Community Lead, Technology Pioneers, World Economic Forum Geneva[/box]

- Start-ups were once synonymous with Silicon Valley or London – but that’s no longer the case.

- Here we look at five emerging global start-up hotspots, and ask which factors make each one so attractive to today’s tech entrepreneurs.

COVID-19 has upended the world and our global society at a pace and in a manner that are both unprecedented. In this era of uncertainty, start-ups play an ever more important role by bringing to market innovative solutions for tackling the challenges and mitigating the negative impacts caused by the pandemic. These days, however, such solutions do not originate solely in Silicon Valley or London; they are coming from other regions of the globe with strong start-up ecosystems and unique values and cultures.

Here we look at five countries – Singapore, the Republic of Korea, Brazil, Kenya and Israel – that have become innovation hotspots and ask how they are attracting entrepreneurs and start-ups, with a specific look at how each government has developed policies to support the ecosystem within their nation.

Testimonials from the new cohort of Technology Pioneers, members of the World Economic Forum’s global community of trailblazing companies, are included to provide on-the-ground voices from each country.

1. Singapore

Singapore came top in the World Economic Forum’s latest Global Competitiveness Report, both overall and in factors such as infrastructure, health, labour market functionality and financial development. The country was ranked 13th in terms of its innovation capability, and boasts numerous factors that attract entrepreneurs. Aside from strong local connectedness and a high-quality stream of talent coming from competitive institutions, the government is at the centre of a drive to implement various start-up-friendly policies to lure start-ups and talent into Singapore. These include tax reduction and exemption schemes, grants and business-incubating and execution infrastructure. Another example is Startup SG, an initiative that was launched in 2017 to unify various aspects of governmental support schemes for ecosystem stakeholders including start-up founders, investors, incubators and accelerators.

Thanks to these concerted government-driven efforts, and a growing private financing ecosystem, investment in Singapore has risen steeply from $2.39 billion in 2017 to $8 billion in 2019, according to Enterprise Singapore. Within the same period, start-ups in deep tech industries such as advanced manufacturing, urban solutions and healthcare have started to gain momentum. The total amount of investment in deep-tech start-ups increased by 260% from $160 million to $580 million over the same period, while traditionally strong industries such as fintech continue to grow. According to an Accenture study, investments in fintech reached $861 million in 2019, more than double the amount raised in 2018.

The success of Singapore’s fintech sector is down in large part to the state’s financial regulator, the Monetary Authority of Singapore (MAS), which provides various kinds of support – including a regulatory sandbox and an API exchange platform to enable live experiments, as well as rapid design and deployment of potential solutions. Jointly organized by EnterpriseSG and MAS, the Singapore Fintech Festival x Singapore Week of Innovation and Technology (SFF x SWITCH), the world’s largest fintech and deep tech innovation festival, attracts numerous talents to connect, collaborate and co-create ideas.

Michele Ferrario of StashAway, which is developing a digital wealth management platform aimed at building long-term wealth, says that Singapore provides a great platform to start and scale services for the more than 600 million people living in South East Asia. “Singapore is a unique place as, at the same time, it provides access to the very fast growing markets of South East Asia while offering the benefits of a global financial centre,” he says. “Having started in Singapore, StashAway benefited from access to local and foreign talent as well as capital, and from the supervision of a very respected and forward-looking regulator.”

The support for fintech is part of the government’s broader support for the overall start-up ecosystem, including enhanced support measures amidst the COVID-19 crisis. For example, up to $110 million has been set aside to enhance the Startup SG Founder programme that will provide venture building, mentorship and start-up capital support for aspiring entrepreneurs. Rolled out in 2017, Startup SG Founder provides first-time entrepreneurs with mentorship support and start-up capital, as well as venture building support through accredited mentor partners who will identify qualifying applicants based on the uniqueness of business concept, feasibility of business model, strength of management team, and potential market value.

2. Israel

Tel Aviv, often dubbed ‘the city that never sleeps’, is famed for being Israel’s start-up capital. Israel – often dubbed the ‘start-up nation’ – has the highest concentration of start-ups per capita globally and is the global leader in deep technologies. With barely any available natural resources, Israel has pursued a path of embracing innovation early on in numerous industries such as water, agriculture and ICT with the aim of becoming the world’s leading powerhouse. The spirit of ‘chutzpah’ (A Yiddish word that means audacity and extreme self-confidence), constant questioning and challenging of the status quo, combined with an ambitious aim to target global markets from the get-go due to its small domestic market, have created an aggressive entrepreneurial mindset within the country. Global tech giants such as Google and Microsoft saw huge opportunities and potential in Israel and, as such, support start-ups in the country both with investment and acquisition. Many entrepreneurs that enjoy successful exits become serial entrepreneurs and patrons to new start-ups that are being formed by the great flow of human capital in Israel, and this virtuous cycle keeps the ecosystem sustainable and vibrant.

Israel’s compulsory military service also plays a part, by providing unique programmes for conscripts that boost their technological skills and help to nurture their creative mindset – all of which encourages them to pursue an entrepreneurial path after leaving the service.

The Innovation Authority of Israel has broadened its mandate to further foster Israel’s innovation ecosystem. This body is responsible for developing innovation infrastructure, provides grants and financial support for innovative technologies and connects the Israeli economy with the outside, as well as promoting and encouraging programmes, policies and laws, all to maintain Israel’s status as the ‘start-up nation’.

Israeli start-ups raised a record $8.3 billion in funding in 2019, a rise of 30% on the previous year, thanks to larger foreign capital investment pouring in, driving industries such as software, internet, life sciences and semiconductors.

There has been a significant rise in investment in AI companies as well as in traditionally strong sectors such as cybersecurity, life sciences and fintech.

Lior Akavia is the co-founder and CEO of Seebo, a Tel Aviv-based AI start-up which enables manufacturers to predict and prevent production losses. He notes that in the last decade the Israeli start-up scene has flourished, particularly in areas like AI – and this has been driven by the wealth of local talent.

“Israel ranks third in the number of AI start-ups globally, and we’re seeing more and more AI unicorns emerge each year,” says Akavia. “Israeli entrepreneurs have demonstrated a keen eye for identifying unaddressed needs in various markets, and matching them to the wellspring of hi-tech talent and creativity here – be that in cybersecurity, digital-health or advanced manufacturing. The advanced manufacturing start-up ecosystem in particular has grown exponentially over the past few years, with more than 260 active start-ups and counting.”

3. The Republic of Korea

The ‘miracle on the Han River’ refers to the Republic of Korea’s rapid economic growth following the Korean War, which transformed the country from a developing into a developed country that now boasts the 12th-largest economy in the world.

South Korea’s economy is primarily driven by large conglomerates like Samsung and LG, called chaebols, which have acknowledged the importance of start-ups as a driver of their continued economic success. TIPS (Tech Incubator Program for Start-ups), a state-led incubation programme, discovers and nurtures promising start-ups by selectively matching them with government funding. As the government takes no equity and provides these funds without any strings attached, start-ups can aim high without having to worry about potential failure – and this has been a game changer, especially when considering the risk averseness of South Korean society.

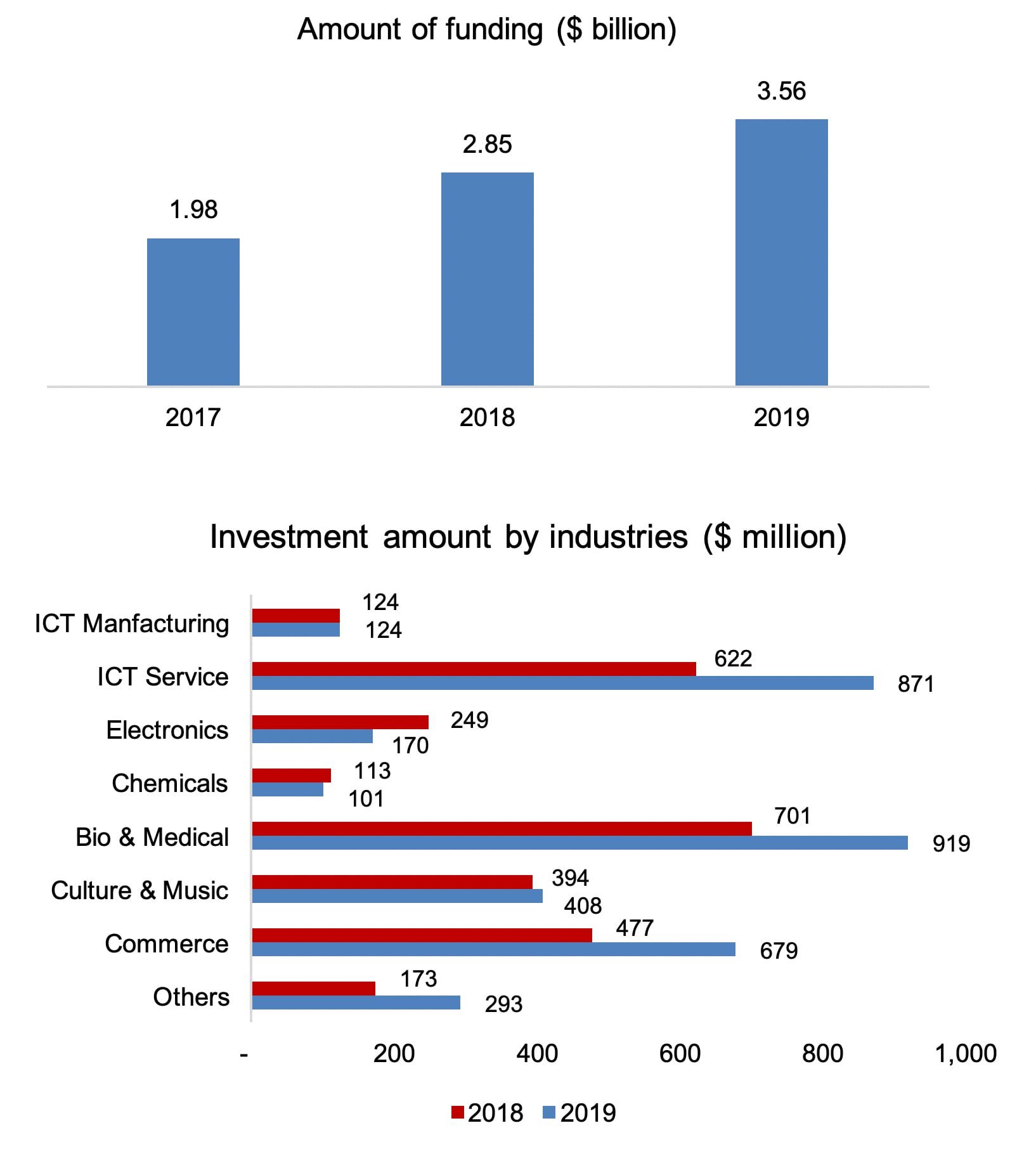

In 2017, the government created the Ministry of SMEs and Startups on a mission to further strengthen competitiveness and support innovation activities for start-ups. According to the Ministry, the amount of funding it provides has increased rapidly. A total of eight government ministries plan to raise 81 venture funds worth $2.1 billion by making fund-of-funds investments. In 2019, more than $3.5 billion of funding made its way into the market – a rise of 25% on the previous year. ICT services, biotechnology and commerce were three sectors that enjoyed a significant increase in funding.

Brandon Suh of Lunit, a Seoul-based start-up that leverages AI to diagnose and treat cancer, says the success behind their company was due to strong early-stage support from the government and other stakeholders within its start-up ecosystem.

“As a start-up, we have benefited from the TIPS programme since the early stages of our development until recently,” he says. “The programme helped us to plant seeds, grow, and further expand as we gradually transformed into an active business. The support from the Korean government and other stakeholders within the innovation ecosystem enabled us to connect with diverse networks within and beyond the industry, which has been helpful in scaling out both domestically and globally.”

4. Kenya

The start-up scene in Africa has been increasingly dynamic over recent years. Total investment in start-ups on the continent passed the $2 billion mark in 2019. A growing population coupled with increasing adoption of mobile devices has enabled numerous digital start-ups to thrive – and Kenya lies at the heart of Africa’s start-up success story.

With English as its native language, a large pool of talent from numerous universities is attracting a number of start-ups to base their headquarters in Kenya. Reliable internet, as well as an excellent online payment infrastructure – centered around the M-PESA service offered by Safaricom – is enabling many mobile-based business models to thrive. In addition, the government supports entrepreneurs in growing and scaling their ideas through its Enterprise Kenya initiative.

Kenya is deemed to be one of the more attractive emerging markets for early 5G deployment, and the government also has ambitious plans to create a so-called Silicon Savannah, which it hopes will generate 2% of GDP within a decade. There is, however, some room for improvement; Kenya’s labour laws are not always well-suited to serving start-ups, and there is a lack of start-up-specific policies around founding and funding.

According to a 2019 report by Partech on Africa’s tech start-up sector, Kenya is ranked second in Africa both in the total amount of funding received by start-ups as well as the number of deals. All showed significant increases over 2018, with a total of $564 million in funding – a rise of 62% on the previous year – spread over 52 deals (a rise of 18% on 2018). Industries such as fintech, off-grid technologies and enterprise are the top sectors with commerce, healthcare and the connectivity sector following close behind.

“We have been fortunate to be a part of the vibrant and supportive start-up community in Kenya,” says Josh Sandler of Lori Systems, a tech-driven logistics services company that coordinates haulage across frontier markets. “Kenya, with its large and growing economy, high tech-penetration rates, strong higher education networks, and relative ease of doing business, has the right ingredients for entrepreneurship to thrive. The presence of organizations such as Alter and Endeavor has also provided us with a network of support. They connected us to local and international funding and mentorship, which have been critical to us scaling.”

5. Brazil

According to the Startup Genome’s Global Startup Ecosystem Report 2020, São Paulo is the only city in Latin America in the world’s top-30 global start-up ecosystems, a clear sign that the city is leading the region’s start-up scene. Brazil has a population of more than 200 million people and is the world’s eighth-largest economy. As such, the country has a large domestic market with high mobile penetration and internet usage, both significantly above the global average. Start-ups also have access to a wide range of funding options both from large international and domestic investors, as well as a pool of talent from universities such as the University of São Paulo and Minas Geraise Federal University.

The Brazilian Government is also trying out various policies to grow the country’s start-up ecosystem. In 2018, it launched the Brazilian Digital Transformation Strategy, which aims to standardize all federal initiatives regarding the innovation ecosystem. The Federal government formed various sub-committees convening different stakeholders of the ecosystem to discuss in detail. There still exist limitations as many of these policies do not truly reflect the true nature of the start-up ecosystem.

The fintech industry had the highest proportion both of the number of deals and the amount invested, and is clearly a key driver of Brazil’s start-up landscape. Several factors point to this sector’s success, including the country’s high mobile usage and larger population of young people, as well as a favourable fintech regulation environment. In November 2019, new draft rules for open banking were set up in Brazil that could potentially disrupt the way existing financial institutions operate – and this could spark further fintech innovation. Numerous innovative start-ups are coming up with solutions to automate the age-old real estate sector, which makes the proptech sector a promising prospect. Start-ups are also at the forefront of revolutionizing Brazil’s old-school hiring processes, which are hampered by factors such as using paper trails and slow hiring processing times.

Federico Vega of CargoX, a São Paulo-based marketplace that connects loads with carriers in Latin America, says that his company has benefited from access to top engineering talent at a relatively low cost. “São Paulo has world-class universities and very little demand for engineering talent when compared to other technology hubs,” he says. “São Paulo also has a great technology start-up culture among engineering graduates; these professionals prefer to work for young technology companies than large traditional corporations.”

Five stars

Each hotspot has its own unique culture and approach towards building vibrant start-up ecosystems. As the COVID-19 situation is likely to negatively impact the operating environment for start-up founders, it will be interesting to see how each country implements its own unique methods for supporting each start-up ecosystem to survive through the unprecedented challenges that we face today.

[box type=”note” align=”” class=”” width=””]License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.